From the few clips of his show that I have seen Bob Schieffer of ABC's "Face the Nation," the host is not a complete shill for the Left like a Chris Matthews or a Rachel Maddow or a scary and angry demagogue like Ed Shultz.

But he asked Paul Ryan the same question everyone in Washington and the mainstream media is asking these days: "If we have such a serious deficit problem, why not tax the rich?" At least he framed it as a question, rather than as a demand. And at least he asked the right guy.

Ever since Obama's much-touted speech the other day in which he attempted to arrest the momentum away from Ryan and re-focus the debate on his own preferred talking points, everybody in the media has hammered away at the same themes: "Tax the rich, tax the rich, tax the rich - and all will be well." Don't worry your head about the problem, just repeat after me "Tax the rich, those millionaires and billionaires, tax the rich and our problems will go away."

Some sincere souls who don't understand much economics and only knows what they hear in the media ask the question sincerely. What would be so wrong with taxing the rich?

I don't have much hope of getting anywhere with the left-wing ideologues (they already know what I'm about to say and simply don't care), but I do think that honest questions deserve honest answers. Why not tax the rich to take care of the budget deficit?

First, references to "wealthy corporations" and to "millionaires and billionaires" are demagogic class warfare rhetoric designed to divide the country into the "good guys" (us) and the "bad guys" (the rich). The reality is that the interests of all Americans are intertwined to a much greater degree than the tired, old, Marxist, class warfare rhetoric allows.

The reality is that many of these supposedly "wealthy" people own small business or are self-employed professionals. They need to be encouraged to hire people, since most new job creation comes from small businesses. And high tax rates discourage job creation, the growth of small businesses and increased tax revenue. So they actually prevent a solution to the budget crisis.

Second, there is not enough wealth in the hands of the really well-off to solve the kind of budget deficits that America faces. So even if the government confiscated all the income of the "millionaires and billionaires" it would still face a shortfall. And how many times can you take it all away? Kings, parliaments, dictatorships and all forms of human government down through the ages have faced this problem: if you eat the sheep where will the wool come from next year?

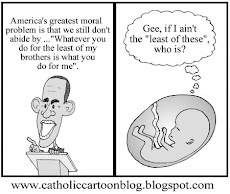

Third, when you put the first two points together, you realize that Obama is being disingenuous when he tries to get you on his side against the "wealthy" today. He is using democracy in the worst possible manner to cobble together a coalition that is held together by a compact by the majority to fleece the minority.

The long range socialist goal always has been to get the majority of the voters to be net recipients of government goodies at the expense of the minority and then to convince the majority to vote for those politicians who will keep the minority in line and the goodies flowing. This is democracy manipulated for self-interest rather than used to pursue the common good. It is in the self-interest of the beneficiaries of government entitlement programs and it is in the self-interest of the politicians and the bureaucratic class of experts who run the government and engage in social engineering.

But if you are part of the middle class, you ought to realize that if fleecing the rich produces insufficient revenues (and it must be so for government appetite for spending is insatiable) and if you support a high tax policy that results in a stagnant economy, what inevitably comes next?

Anyone with any common sense can look at Greece or Spain or Portugal and see the long term effects of increasing government spending coupled with cripplingly high tax rates. The standard of living of all must decrease and the mechanism of this decrease is higher and higher taxes on the middle class.

Obama has consistently promised that he won't increase taxes on households making under $250,000 but what people need to grasp is that his policies on spending, entitlement reform, and tax reform (not to mention his penchant for environmental regulations and his unwillingness to address unsustainable public sector union benefit programs that are a ticking time bomb for state governments across America) - all this make his promise impossible for future presidents to keep. Yes, the word is impossible.

Rationing in health care and perpetually higher and higher taxation are the only plans Obama (and the Left generally) has for addressing the deficit. This week in Washington made that abundantly clear to anyone who did not already know it. The future of such policies is economic decline, higher taxes, a declining lifestyle for all American and the erosion of the social safety net for the poor, the handicapped and the elderly.

Why not tax the rich? The real answer is because it is bad for all of us.

Capitalism is a system that works on the basis of enlightened self-interest. It treats people as responsible adults who know what they want better than government bureaucrats do and allows people to work as hard or as little as they like. It is not a system based on greed but on individual freedom, which is a very different thing. Capitalism allows people maximal freedom to pursue their own priorities and their own self-interest and yet allows them to weave their own individual life projects into a tapestry in which the needs of all are met. Capitalism is not meant to address the problem of those who cannot work: that is what private charity and a modest, means-tested, government social safety net are for.

But the fact is that taxing the rich more and more (endlessly, in fact) is not in our enlightened self-interest. It is far better for us that more wealth be created, that more jobs be created and that more and more middle class people join the ranks of the wealthy because the more this happens the better off all of us will be. Social mobility and the absence of a European-style class structure have been among the most appealing features of America ever since its beginning.

The rich are the entrepreneurs who create jobs, wealth and who do pay taxes already. The corporate tax rate in the US is 35%, which is among the highest in the world. We need to respect entrepreneurs, not treat them like pariahs or milking cows for our use. These days, the only way rich people can avoid being treated like pariahs in progressive circles is to beat their breasts and call for higher government taxes and more government programs for the poor. Then, in exchange for being class traitors they typically get tax loopholes and the public gets stuck with higher deficits. This system of crony capitalism is inherently corrupting and contrary to the rule of law. There is a direct connection between the high tax rate and the high number of loopholes and simply increasing the tax rate will not help this problem. In fact, Doug Saunders, in The Globe and Mail, offers a rationally compelling case for abolishing corporate taxes.

When the government regulates everything it controls everything and true capitalism is destroyed. When business is forced to prostitute itself to government it means that we have socialism by other means. And the result is economic stagnation because the government does not create wealth - as any honest Marxist will tell you - it only redistributes it. As the pie shrinks due to misguided government interference in the economy, the individual slices shrink too. Everyone's energy is then directed toward fighting for a slightly bigger share rather than on creating a bigger pie.

Obama and the Left would rather everybody be poorer if that meant more relative equality. That kind of philosophy creates a Cuba and a North Korea and Greece. It does not create a United States of America. But it has the potential to destroy any nation that embraces it fully.

Subscribe to:

Post Comments (Atom)

3 comments:

Great post. Another point would be that when the rich are overtaxed, they simply stop creating new capital (for the risk is greater than the reward, especially when the government assumes none of your risk and 35-100% of your reward). Or the rich will just simply flee with their capital. There is a major flight of capital flowing out of the United States. Many of those who flee no longer care about the punishments because the stakes are too high. If the government is going to basically confiscate everything you own, you may as well flee with your money and hope that you don't get caught. It is now a felony to travel across the border with over $10,000. This used to be about money laundering and terrorism. But it is now about keeping the capital from fleeing to more friendly jurisdictions: e.g., Grand Cayman, Barbados, Switzerland.

The US should make their territory capital friendly instead of trying to punish and destroy those who flee. Then the flow of capital would turn back to the US instead of away.

Finally, Obama, Federal Reserve and Congress are conspiring to tax all Americans by debauching the US dollar. So while saying they will keep taxes low for wage earners and promise to stick it to the rich, they are actually destroying people's earnings, that is the earnings of those who still have an income--in turn they are giving it to those who are unproductive in the form of wages, pensions, food stamps, unemployment benefits, etc. So it is a lie that Obama is for the little guy. He's stealing with Bernanke's and Congress's help from the wage earner too.

Finally, I wish to nitpick this one line:

"Capitalism is not meant to address the problem of those who cannot work: that is what private charity and a modest, means-tested, government social safety net are for." Once you allow government to create the safety net it is game over. You give them an inch they take a mile. Therefore, all safety nets should be abolished, making room for private charities, families, and the vaunted village (it takes a village ...) of the left to care for those who are unable to fend for themselves. When government overtaxes and offers charity, the first thing it destroys is the family, that can shirk its duty to care for its own. It leads to a breakdown of the family.

Peter,

On your nit-picking: I am not sure what I think. I have great sympathy for your view; it is the voice of logic and reason. But I'm not sure I would agree that the state has no role in supporting the poor and needy. Your view is ideal, however. I need to think about this more.

I don't think anyone wants to "fleece" the rich. We want them to pay their fair share and presently they do not. It is simply unconscionable for the rich to enjoy the tax breaks they do while deep cuts are made to programs like social security, medicare and pell grants. It's not about "class warfare" it's about WHAT IS FAIR. As a supposed Christian, you should understand that.

Jesus looked up and saw the rich putting their gifts into the offering box, and he saw a poor widow put in two small copper coins. And he said, “Truly, I tell you, this poor widow has put in more than all of them. For they all contributed out of their abundance, but she out of her poverty put in all she had to live on.”

Luke 21:1-4

Post a Comment