The article, "FDR's policies prolonged Depression by 7 years, UCLA economists calculate" presents this conclusion as a great surprise. They seem to think that no one has ever suggested before that it might have been FDR's fault. I suspect that it might come as an even bigger surprise to the article's author that this conclusion comes as no surprise whatsoever to conservatives. Progressivism can be such a narrow cocoon in some ways.

Here is a bit from the article:

Two UCLA economists say they have figured out why the Great Depression dragged on for almost 15 years, and they blame a suspect previously thought to be beyond reproach: President Franklin D. Roosevelt.

After scrutinizing Roosevelt's record for four years, Harold L. Cole and Lee E. Ohanian conclude in a new study that New Deal policies signed into law 71 years ago thwarted economic recovery for seven long years.

"Why the Great Depression lasted so long has always been a great mystery, and because we never really knew the reason, we have always worried whether we would have another 10- to 15-year economic slump," said Ohanian, vice chair of UCLA's Department of Economics. "We found that a relapse isn't likely unless lawmakers gum up a recovery with ill-conceived stimulus policies."

In an article in the August issue of the Journal of Political Economy, Ohanian and Cole blame specific anti-competition and pro-labor measures that Roosevelt promoted and signed into law June 16, 1933.

"President Roosevelt believed that excessive competition was responsible for the Depression by reducing prices and wages, and by extension reducing employment and demand for goods and services," said Cole, also a UCLA professor of economics. "So he came up with a recovery package that would be unimaginable today, allowing businesses in every industry to collude without the threat of antitrust prosecution and workers to demand salaries about 25 percent above where they ought to have been, given market forces. The economy was poised for a beautiful recovery, but that recovery was stalled by these misguided policies."

He thought that "excessive competition was responsible for the Depression by reducing prices and wages." What an unbelievable thing to believe. If Roosevelt actually believed that, he was utterly incapable of thinking clearly about the situation. This smacks of a know-nothing, blame the rich, class-warfare approach.

The article discusses the National Recovery Administration's role in preventing the market's natural functioning:

Using data collected in 1929 by the Conference Board and the Bureau of Labor Statistics, Cole and Ohanian were able to establish average wages and prices across a range of industries just prior to the Depression. By adjusting for annual increases in productivity, they were able to use the 1929 benchmark to figure out what prices and wages would have been during every year of the Depression had Roosevelt's policies not gone into effect. They then compared those figures with actual prices and wages as reflected in the Conference Board data.

In the three years following the implementation of Roosevelt's policies, wages in 11 key industries averaged 25 percent higher than they otherwise would have done, the economists calculate. But unemployment was also 25 percent higher than it should have been, given gains in productivity.

Meanwhile, prices across 19 industries averaged 23 percent above where they should have been, given the state of the economy. With goods and services that much harder for consumers to afford, demand stalled and the gross national product floundered at 27 percent below where it otherwise might have been.

"High wages and high prices in an economic slump run contrary to everything we know about market forces in economic downturns," Ohanian said. "As we've seen in the past several years, salaries and prices fall when unemployment is high. By artificially inflating both, the New Deal policies short-circuited the market's self-correcting forces."

The policies were contained in the National Industrial Recovery Act (NIRA), which exempted industries from antitrust prosecution if they agreed to enter into collective bargaining agreements that significantly raised wages. Because protection from antitrust prosecution all but ensured higher prices for goods and services, a wide range of industries took the bait, Cole and Ohanian found. By 1934 more than 500 industries, which accounted for nearly 80 percent of private, non-agricultural employment, had entered into the collective bargaining agreements called for under NIRA.

Cole and Ohanian calculate that NIRA and its aftermath account for 60 percent of the weak recovery. Without the policies, they contend that the Depression would have ended in 1936 instead of the year when they believe the slump actually ended: 1943.

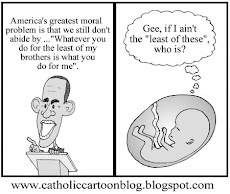

The parallels to today are stunning and frightening. Obama's artificial, ad hoc, arbitrary pattern of government intervention into various sectors of the economy are based on political calculations rather than economic theory (eg. the need to save the auto workers' pensions and preserve an important voting block and source of campaign contributions as the motivation for "saving" GM and Chrysler at the expense of bondholders).

If Cole and Ohanian are right, we can expect the recession to end right after the 2012 presidential election on one condition: that a Republican is elected to replace Obama.

__________

PS - It ought to be borne in mind that the longer the Great Recession goes on, the more the poorest people in North America will be hurt. Anyone concerned about the poor should be extremely concerned to determine for themselves if in fact Obama's progressive policies are actually extending the economic downturn, causing high unemployment and ultimately leading to government spending cuts in welfare programs.